Describe the Saving Borrowing Investing Cycle

Investing is buying assets such as stocks bonds mutual funds or real. You are familiar with the concept of leverage if youve ever.

Efinancemanagement Accounting And Finance Finance Investing Finance Class

The saving borrowing-investing cycle is certain ways in witch people can use their money when they save it you can place it in youre bank.

. Why cant government provide employment opportunities to all the families with low quality of life. It can reflect attitudes to borrowing saving and social expectations. Describe the saving-borrowing-investing cycle Describe the saving-borrowing-investing cycle Answers.

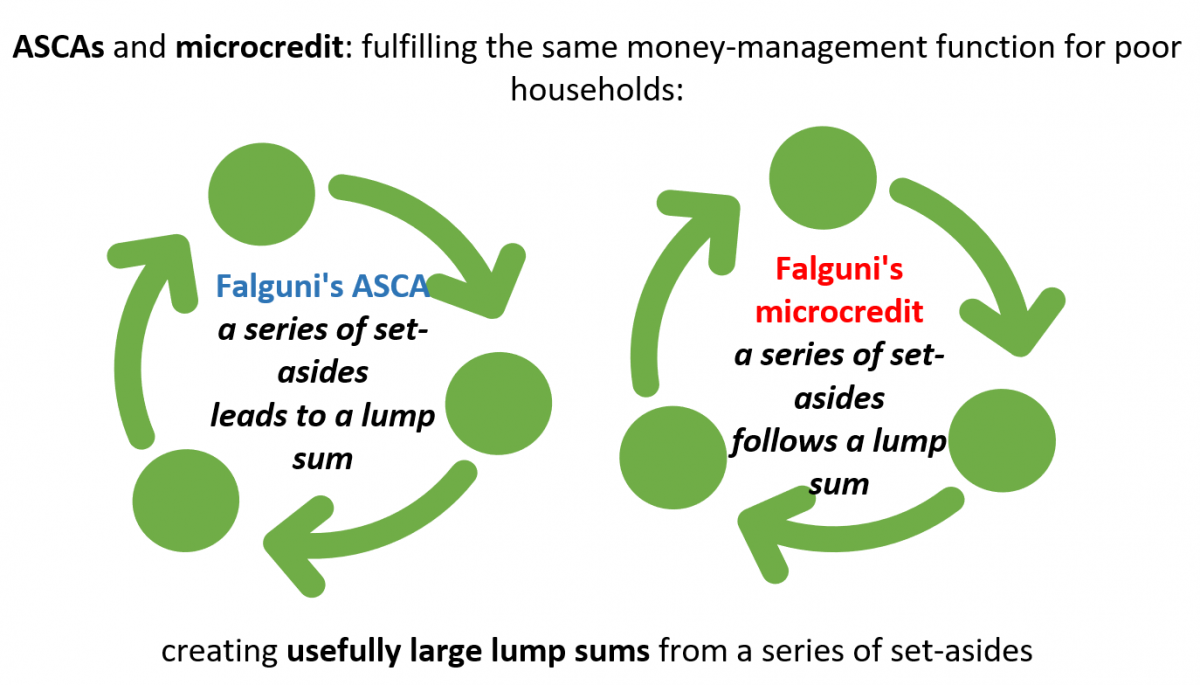

When individuals borrow to start a business its an investment. Financial institutions offer a number of different savings options. Saving rates can vary between countries.

H is very ill and the family has been told she will probably die during this hospital admission. Social Studies 22062019 1430. For example thrift and saving can be seen as highly desirable in Germany where there is a greater aversion to debt.

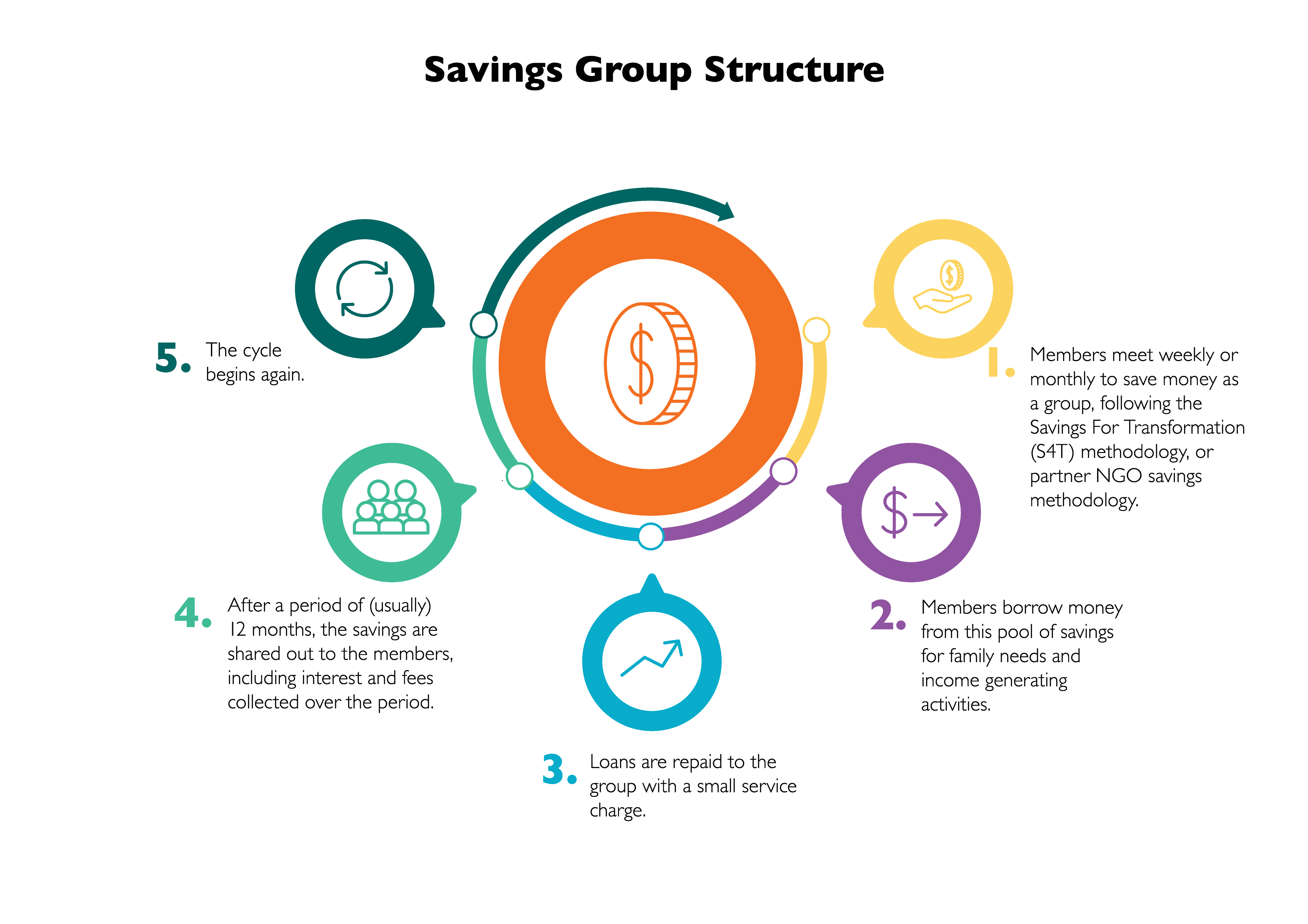

Saving borrowing and investing help to keep money moving and active. Social Studies 22062019 0140. The theory states that individuals seek to.

3 Show answers Another question on Social Studies. When businesses borrow to expand they are investing. In 13 sentences describe the saving-borrowing-investing cycle.

Social Studies 21062019 1610 astridantonio225. 3 Show answers Another question on Social Studies. Hs family is in the waiting room of the intensive care unit.

Using savings to produce a better return than you would get from interest in a deposit account with a financial institution. What is the savings-borrowing-investing cycle The saving-borrowing-investing cycle generally begins with consumer borrowing to fund their purchases and for seed capital and they then use this capital to invest in their future. The saving-borrowing-investing cycle generally begins with consumer borrowing to fund their purchases and for seed capital.

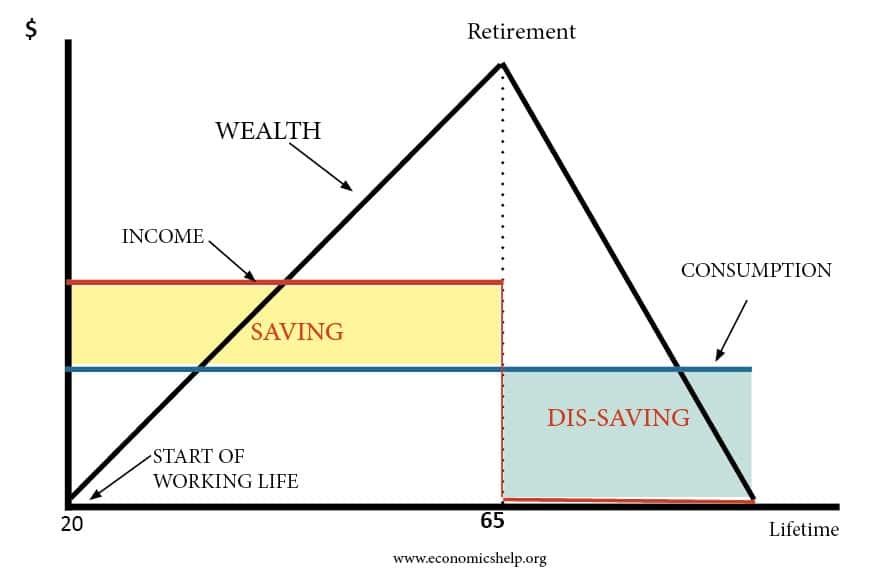

7 yearly and differs depending on the type of fund. Saving rates by country. The Life Cycle Theory of Consumption and Saving.

Its money you want to be able to access quickly with little or no risk and with the least amount of taxes. This can be short - 1 year medium - 5 years or long term - 20 years. The life-cycle hypothesis LCH is an economic theory that describes the spending and saving habits of people over the course of a lifetime.

Saving is setting aside money you dont spend now for emergencies or for a future purchase. The MER ranges from 0. When you borrow a sum of money for a fixed period of time and you re-pay it in fixed instalments on a regular basis.

Leveraged investing1 is defined as borrowing money to finance an investment. Borrowed money to make additional contributions to your RRSP Used a credit line for investing Bought securities on margin from a stock broker Both individuals and companies use leverage as an investment strategy. Workers can smooth their consumption by borrowing while they are young saving in middle age and dissaving during retirement.

Banks loan out a portion of the money to other people. You are walking by. In 13 sentences describe the saving-borrowing-investing cycle.

The UK has a greater willingness to borrow and run down savings. Savings in financial institutions provide funds for businesses and households to borrow and invest. The saving-borrowing-investing cycle generally begins with consumer borrowing to fund their purchases and for seed capital and they then use this capital to invest in their future.

In what ways did the compromise of 1850 and the kansas-nebraska act of 1854 differ from the missouri compromise. The proceeds of investments are deposited in banks loaned out again and the cycle continues. They then use this capital to invest in their future which then allows them to bring in more money.

When people save money in a bank the money does not just sit there. A Model of Saving and Spending. 1 Get Other questions on the subject.

There are lots of costs an investor will sustain when purchasing mutual funds Savings-borrowing-investing Cycle Definition. The Calvin Cycle begins with carbon fixation carbon bonds to sugar then the reduction phase where there is energy released as a result of the conversion. The life cycle theory of savings suggests that people prefer smooth consumption over their lifetime.

Describe the steps of the Calvin Cycle. However the greater the. A company with a lot of.

They then are able.

Methods For Preparing The Statement Of Cash Flows Cash Flow Statement Cash Flow Accounting Basics

Savings Group Loan Sustainable Development Finance

Vendor Financing Meaning Importance And Types Financial Life Hacks Finance Meaning Money Management Advice

Life Cycle Hypothesis Economics Help

Advantages And Disadvantages Of Bank Loans Finance Investing Bookkeeping Business Finance Saving

Difference Between Lease And Finance Economics Lessons Accounting Basics Finance

The Fed Controls Money Supply Influences Interest Rates Our Economy And Our Financial Markets To Learn More Investing Yo Investors Understanding Investing

Vendor Financing Meaning Importance And Types Financial Life Hacks Finance Meaning Money Management Advice

In 4 To 6 Sentences Explain The Savings Borrowing Investing Cycle Brainly Com

Syndicated Loan Finance Investing Accounting And Finance Money Management Advice

First Step To Stop Borrowing And Start Saving Money Tips Credit Card Interest The Borrowers

Debt Vs Equity Finance Investing Learn Accounting Accounting Basics

In 4 To 6 Sentences Explain The Savings Borrowing Investing Cycle Brainly Com

Simple And Easy Ways To Learn About Finance Finance Investing Borrow Money

Bangladesh S Microsavings Revolution The Country Has Done Well In Savings As Well As Credit E Mfp

Comments

Post a Comment